All About PCI-DSS Training with InfosecTrain

Table of Contents

What is PCI-DSS?

What is the PCI-DSS Training Course with InfosecTrain?

PCI-DSS Course Content

Career Opportunities after Pursuing PCI-DSS Course

Why PCI-DSS Training Course?

What is PCI-DSS?

Payment Card Industry Data Security Standard (PCI-DSS) is a security standard that applies to all entities that store, secure, or transmit information about the cardholder. It refers to the technical and operational system components contained in or linked to cardholder data. PCI-DSS applies to you if you accept or process credit or debit cards.

The Payment Card Industry Data Security Standard was developed by the Payment Card Industry Security Standards Council (PCI-SSC), which is controlled by the payment brands listed below:

- VISA

- MasterCard

- JCP

- American Express

- Discover Financial Services

PCI-DSS was created to promote and improve cardholder data security while facilitating the widespread adoption of consistent data security measures worldwide. PCI-DSS compliance is typically required of any organization involved in payment card processing, including storing, processing, or transmitting Cardholder Data (CHD).

What is the PCI-DSS Training Course with InfosecTrain?

InfosecTrain’s PCI-DSS training course is specifically designed to give you a deep understanding of how to manage the risks associated with payment card transactions. Eventually, this course covers the core fundamentals of the PCI-DSS standards family and the 12 essential requirements and controls. You will understand how to implement a PCI-DSS compliant program in your organization to prevent data loss.

This training course will be an excellent opportunity for those seeking a rewarding career in data security. This course will prepare you to protect payment data throughout the payment lifecycle and how to use technology to evaluate data and remove the incentive for criminals to steal it.

PCI-DSS Course Content

Let’s take a look at what you’ll study and comprehend during this course:

- This course will provide you with a thorough understanding of security breaches and issues with credit card theft, identity theft, and personal data theft.

- You’ll learn everything there is to know about PCI-DSS, as well as risk, threat, and asset identification in the organization.

- You will learn the impact of data compromises and increasing risk for cardholder data.

- You will grasp the high-level PCI-DSS requirements as well as the several levels of PCI-DSS.

- You will grasp what an Accounting Information System (AIS) is, how to collect financial information, and its various components.

- You will understand the payment application scope.

- You will learn how to put compensating controls in place.

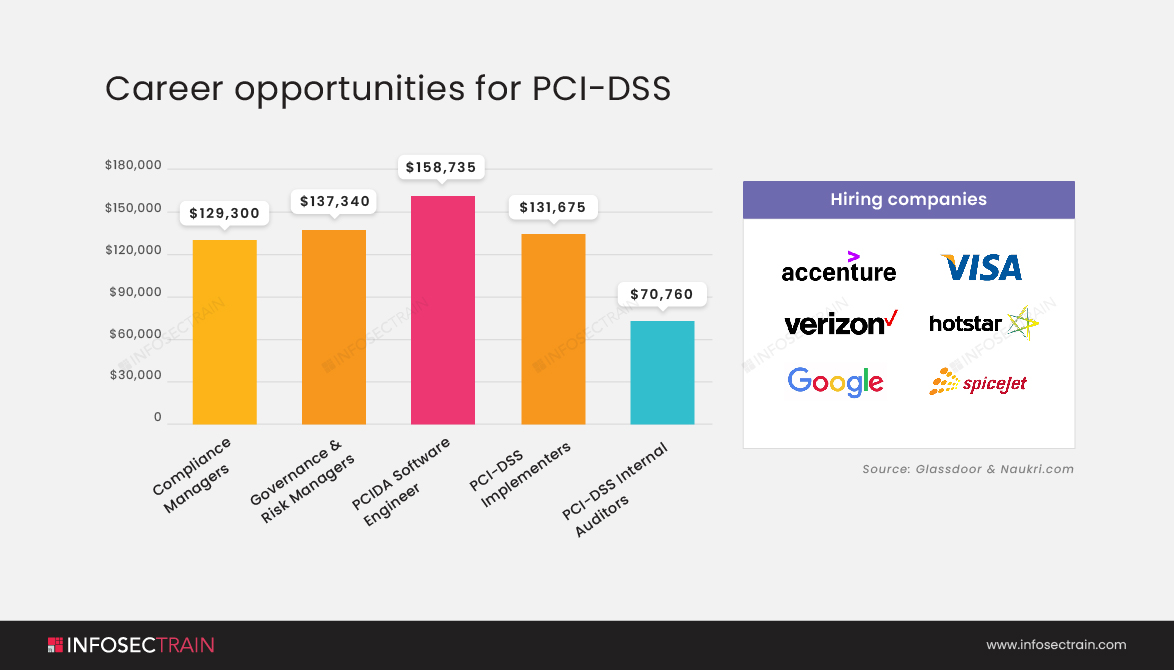

Career Opportunities after Pursuing PCI-DSS Course

PCI-DSS was developed to encourage and strengthen cardholder data security while making uniform data security procedures more widely adopted worldwide. Today’s digital world faces identity theft and fraud, which is on the rise, impacting both large and small organizations. A data breach is not only harmful to your organization, but it also has an impact on your users. Obtaining PCI-DSS compliance will help reduce costs by assisting in the prevention of data breaches and will also result in the avoidance of fines. PCI professional accomplishes this by providing a high-level overview of the PCI Data Security Standard (PCI-DSS).

In large organizations subject to periodic assessments by a Qualified Security Assessor (QSA), having PCI professionals in the company can make that assessment easier because they understand what to anticipate from a QSA, what the QSA will be looking for, and how to provide that corroboration.

So, here are the most common PCI job roles you can get, along with their salaries:

- Compliance Managers: The Compliance Manager creates and implements programs, policies, and procedures to ensure that the organization complies with federal, state, and local regulations.

- Governance and Risk Managers: The Governance and Risk Manager will be responsible for ensuring that the various company policies are followed, which will necessitate a thorough understanding of the policies, maintaining excellent relations with stakeholders, and adhering to the organization’s goals.

- PCIDA Software Engineer: The PCIDA Software Engineer is responsible for developing a multi-platform version of the software package and creating scalable, automated solutions for the company’s customer base.

- PCI-DSS Implementers: PCI-DSS Implementers are responsible for locating, collecting, organizing, and reviewing relevant evidence across multiple platforms and applications to determine compliance with PCI-DSS controls.

- PCI-DSS Internal Auditors: A PCI audit is a thorough examination of a merchant’s compliance with PCI-DSS criteria, including multiple specific controls or safeguards for securing cardholder data. The PCI-DSS Internal Auditors perform all these tasks in any business.

Why PCI-DSS Training Course?

One of the most challenging tasks today’s organizations face is the responsibility and security of customers’ data and payment transactions. Proper handling of the personal data of the payment cardholder is a business requirement. Without going above and beyond, your payment systems are hacked. To reduce these consequences, organizations need professionals with complete knowledge and understanding of protecting these cybercrimes.

One such professional is the PCI professional. Organizations require them to build and maintain a secure network, protect cardholder data, create a vulnerability management program, etc. In this PCI-DSS Training course, you will learn how to prevent and mitigate all data theft and identity theft processes in order to protect cardholder data.

Why PCI-DSS Training Course with InfosecTrain?

If all of the above PCI-DSS information has attracted your interest in pursuing a career as a PCI-DSS professional, InfosecTrain is here to assist you. The PCI-DSS training course consists of 30 hours of instructor-led instruction that covers all PCI-DSS requirements and levels of compliance. InfosecTrain is a renowned cybersecurity and information security training and consulting company that specializes in IT security and data privacy training.

Here are plenty of factors you might consider to enroll in this PCI-DSS Training course with InfosecTrain, such as:

- You will be instructed by certified and experienced instructors who are well-versed in the subject matter.

- The training session will be flexible, and you will have access to lecture recordings.

- After completing your training, we also offer post-training support if you need any help regarding your course.

- In addition, there is an interactive Q&A session.

So, enroll with InfosecTrain right now and learn everything you can about PCI-DSS. The skills you will learn are becoming increasingly valuable and sought-after in today’s security-conscious digital world.

1800-843-7890 (IN)

1800-843-7890 (IN) sales@infosectrain.com

sales@infosectrain.com

1800-843-7890 (India)

1800-843-7890 (India)