Roadmap To Achieving The PCI-DSS Certification

About Payment Card Industry Data Security Standard (PCI-DSS)

The Payment Card Industry Data Security Standard is a widely recognized and accepted information security standard that allows organizations to regulate a large assortment of credit cards through card schemes that are widely available. All card companies must essentially adhere to the PCI standard, managed and developed by the Payment Card Industry Security Standards Council. All businesses that store, process, or transmit cardholder data and information are subject to the PCI-DSS. This worldwide mandate standard applies to all major central banks around the globe. The PCI standards are tailored for three communities:

- Merchants and processors

- Software developers

- Manufactures

PCI-DSS Compliance

Adherence to rules, which can be policies, methods, norms, or even laws, involves compliance. All businesses and organizations must adhere to a set of rules and regulations across the globe. The five credit card companies, MasterCard, VISA, JCP, American Express, and Discover financial services, comply with the Payment Card Industry (PCI). It raises the level of security for all credit card transactions. PCI requirements are classified into two types:

- Technical

- Operational

All organizations must use these standards to secure and protect their customers’ credit card information. PCI standards must be followed by any company or organization that accepts credit cards because every major credit card company follows them.

PCI-DSS Certification

PCI-DSS ensures payment card data security at your company or organization through a set of requirements formed by the PCI SSC. Among them are several well-known best practices, such as:

- Firewall installation

- Encryption of data transmission

- Use of anti-virus software

The Payment Card Industry Data Security Standard certification allows you to be recognized as a Certified Payment Card Industry Security Implementer, giving you a strategic advantage in the following areas:

- Understanding the standards and requirements of the payment card industry

- Evaluate the PCI-DSS standard to ensure the highest level of cardholder’s data security

- Hands-on experience with ideas, techniques, and best practices while exploring case studies and real-time scenarios to understand the controls

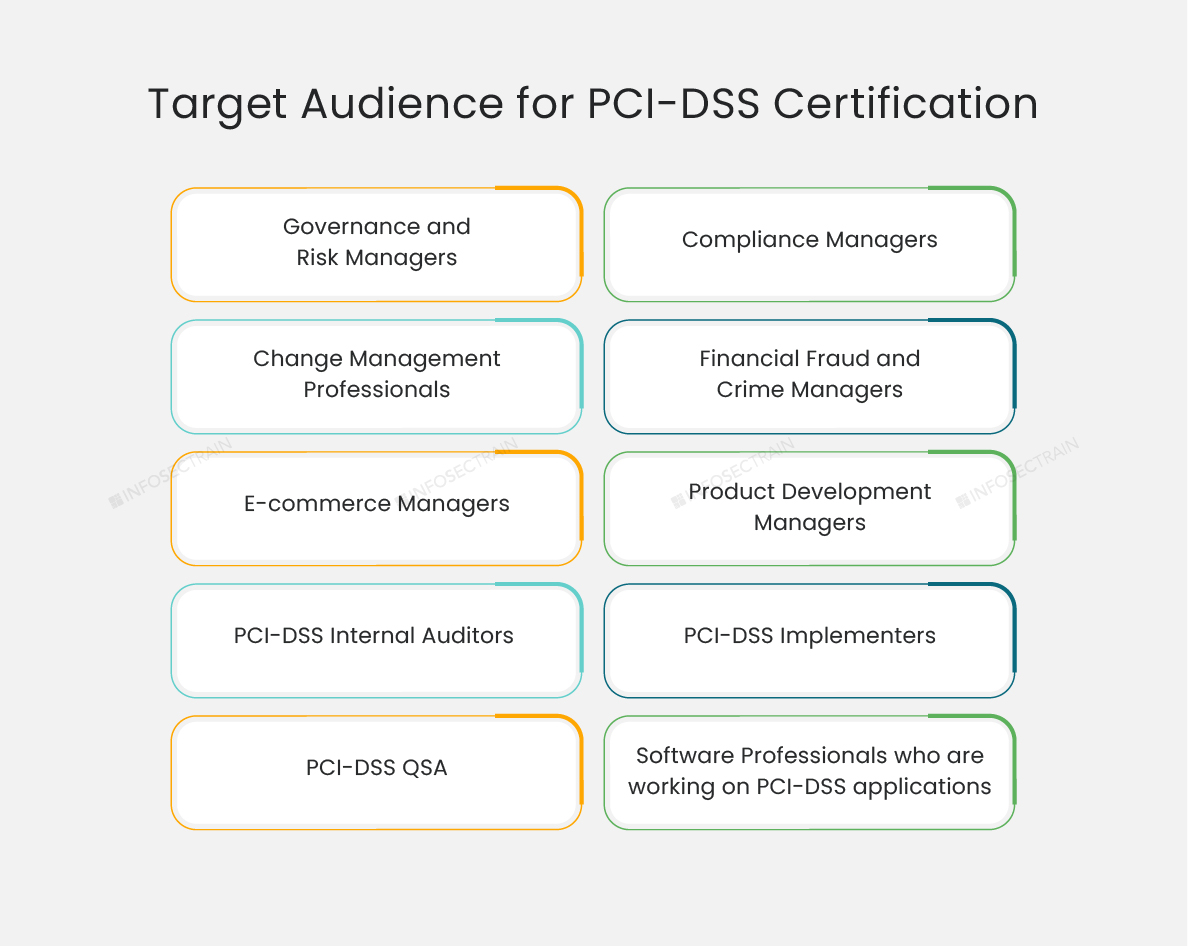

Target Audience for PCI-DSS Certification

Those who wish to progress in their careers in data security and achieve a higher level of professionalism in the security industry are the target audience for this certification. Members of higher management who are responsible for implementing the PCI-DSS within the organization, such as:

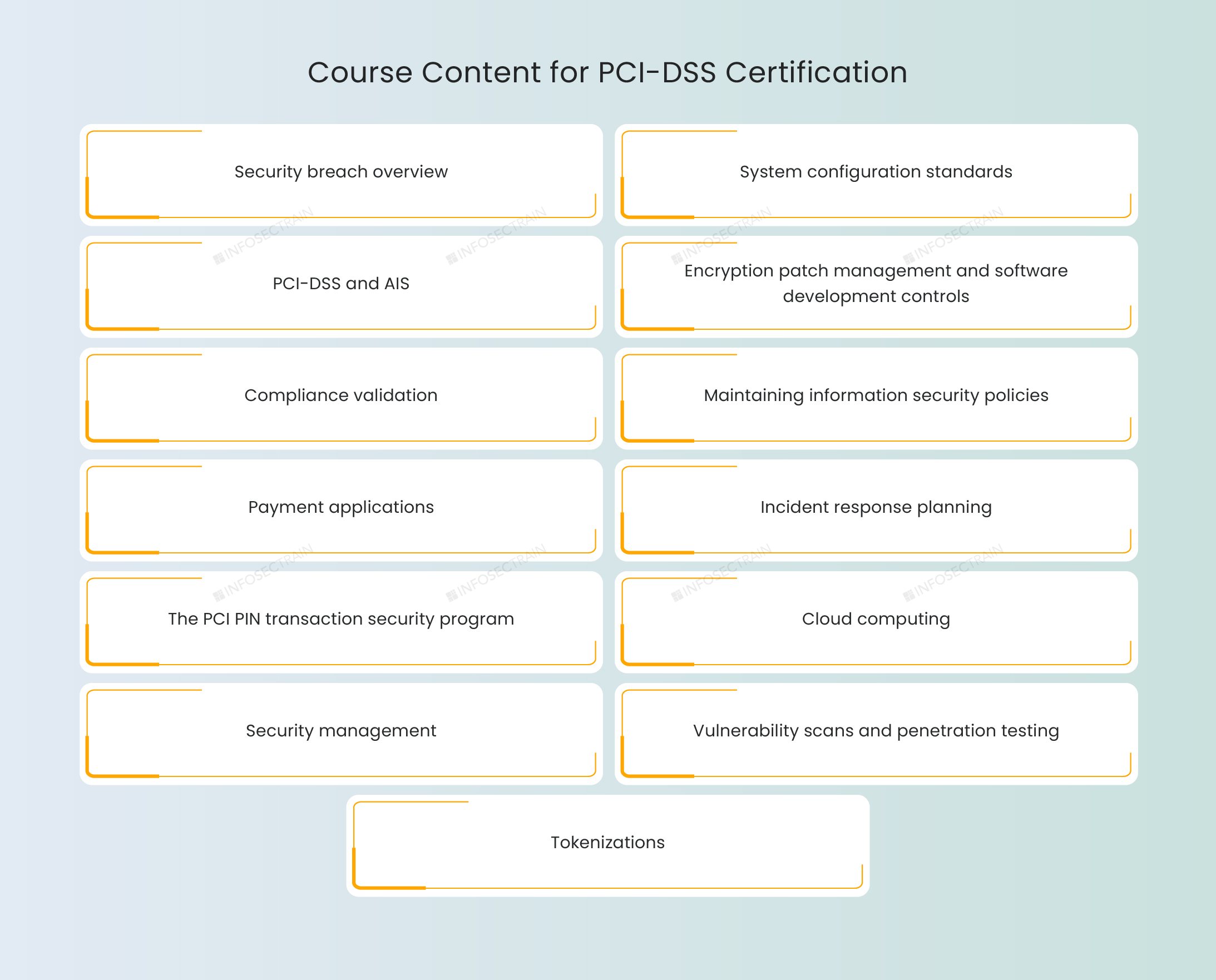

What is covered in the certification for PCI-DSS?

The PCI-DSS certification covers the following topics:

Why PCI-DSS Certification?

Here are some of the reasons to get PCI-DSS certified, which are as follows:

- Ensures a holistic understanding of security: The PCI-DSS certification assists those in charge of security controls in comprehending how their contribution fits into the larger picture. Operating security controls is a never-ending process, and we all know that the controls must be integrated into everyday work practices to be effective. This is done by PCI-DSS professionals who have a broad understanding of the PCI Data Security Standard (PCI-DSS).

- Aids in the assessment process: PCI-DSS professionals in big organizations are subject to annual assessments by a Qualified Security Assessor (QSA). A QSA (Qualified Security Assessor) can make that assessment easier because they know what to expect from a QSA, what the QSA will look for, and how to provide that corroboration.

- It’s an individual thing: If you work for an organization whose customers must comply with the PCI-DSS, you must be able to reassure them that you understand their needs and that your services will help them achieve compliance. And to do so, you’ll need to know about PCI-DSS, which is where PCI-DSS certification comes in.

Guide to PCI-DSS Compliance Certification

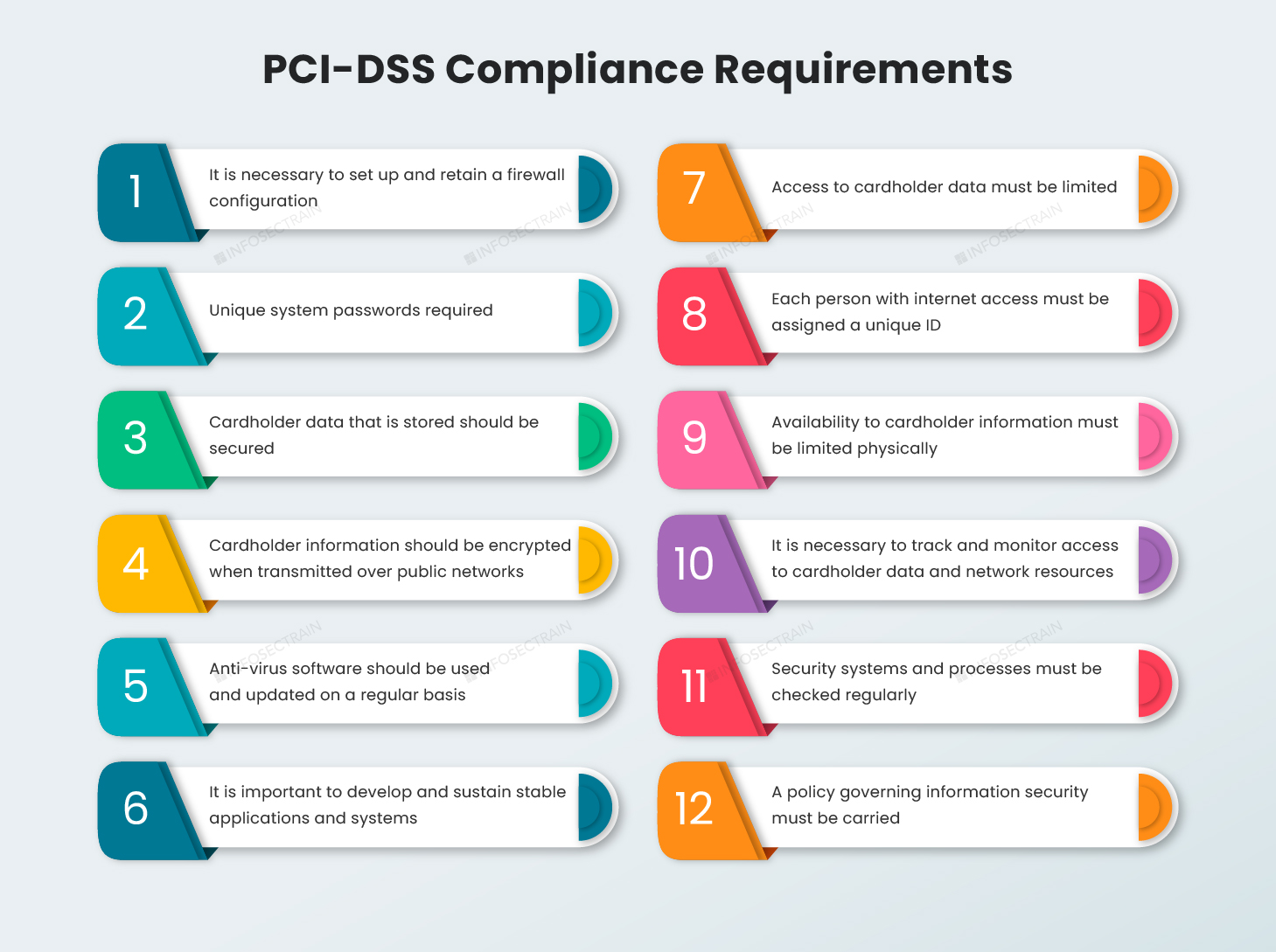

1. Know the PCI Compliance Requirement

A business must meet approximately 12 general requirements to be PCI-DSS compliant. Here is the list of 12 requirements organizations must follow:

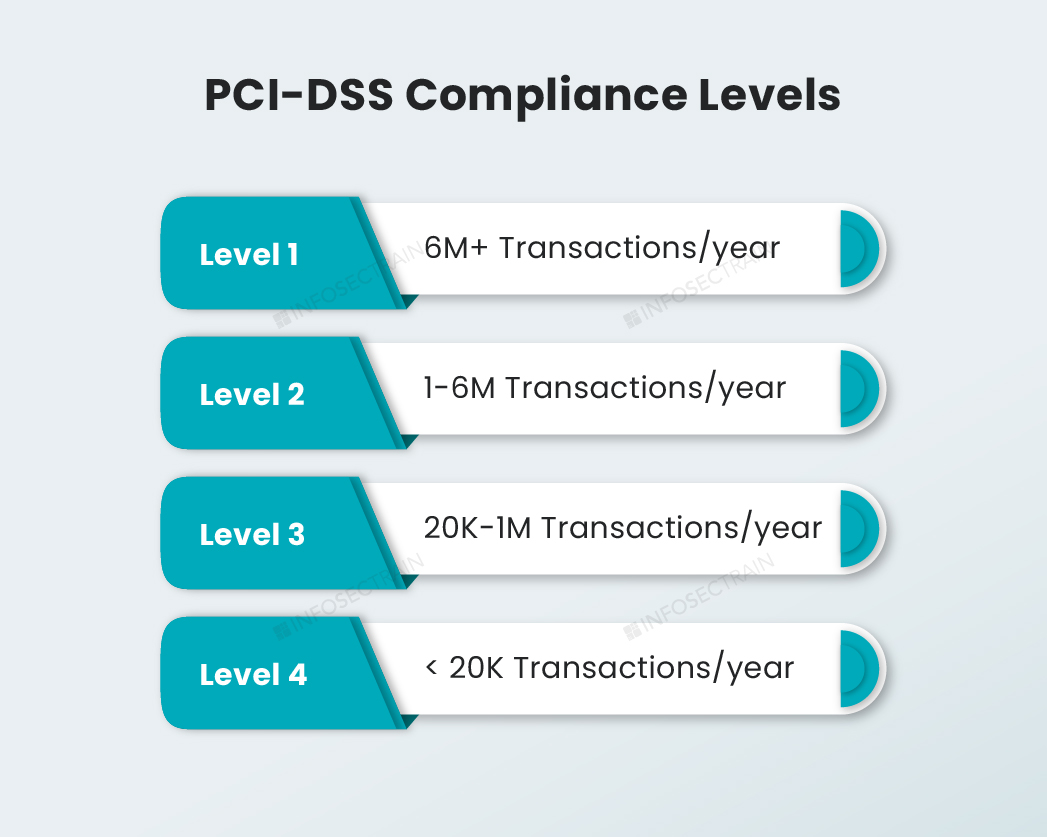

2. Know the PCI-DSS Compliance Levels

- Select from the applicable Self Assessment Questionnaire (SAQ)

- An authorized person at merchants can complete and sign the SAQ

- A qualified person at the service provider can complete and sign the SAQ

- Onsite assessment by Qualified Security Assessor (QSA)

- QSA submits Reports on Compliance (ROC) and Attestation of Compliance (AOC)

PCI-DSS compliance levels for business processes are divided into four stages based on the annual number of credit or debit card transactions. The classification level determines what an organization must do to remain compliant.

3. Know About PCI-DSS Audit

A PCI-DSS certification verifies that a company was PCI compliant during the certification period. Businesses work with qualified auditors to achieve certification by ensuring that the standards are met. The audit process can take months, depending on the size of the company and the volume of transactions. Internal audits are required for Level 1 businesses.

4. Know the Importance of PCI-DSS Compliance

PCI-DSS compliance is essential if you want to process card transactions, protect cardholder data, and reduce the risk of an expensive violation. While the PCI-DSS isn’t a legal obligation, credit card data is considered personal data under the GDPR, which means you’re legally obligated to keep it safe and protected.

PCI-DSS with InfosecTrain

InfosecTrain is a leading IT training and consulting service provider specializing in a wide range of globally recognized security certifications. EC-Council, Microsoft, CompTIA, PECB, and ISACA are just a few of our well-known partners. We have highly qualified and skilled trainers in various security concepts who are dedicated to providing quality information. We also offer full-fledged preparation materials for these security-related certification exams. InfosecTrain is the best place to go if you want to take the necessary training for PCI-DSS.

1800-843-7890 (IN)

1800-843-7890 (IN) sales@infosectrain.com

sales@infosectrain.com

1800-843-7890 (India)

1800-843-7890 (India)